Comment

ESG due diligence for real estate

Whilst due diligence (‘doing your homework’) during the acquisition of assets has long been a consideration for lenders & investors, there is a growing demand for the consideration of Environmental, Social & Governance (ESG) issues to future proof investments. The lack of a best practice industry standard approach; however, unlike traditional legal and commercial analysis, can leave businesses struggling with the best approach to take.

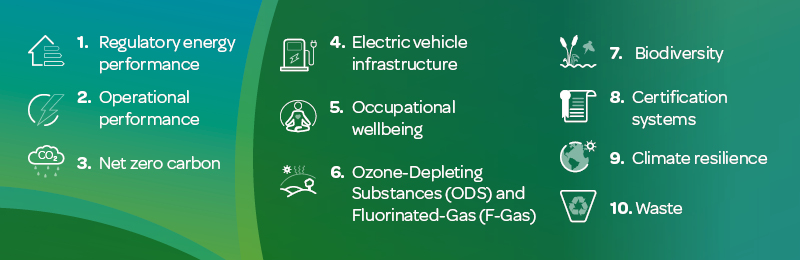

Director, Snigdha Jain shares her top ten themes for consideration to future proof investments and facilitate decision making for real estate, for a deals market that is increasingly ESG savvy.

Identifying the material ESG findings as part of the due diligence process is often the first step in the journey to influencing decision making, engagement with supply chains, risk management and value creation; so, it is important for investors and finance providers to have an agreed position on their priorities in an increasingly ESG-aware deals market.

Undoubtedly there will be nuances of strategic objectives, stakeholder demands and sector specific risks that demand flexibility in the approach but some common themes are starting to emerge as the ESG market matures.

1) Regulatory energy performance

This typically involves a review of the current Energy Performance Certificate (EPC), used as a proxy for operational carbon and running costs for which minimum standards are set under the MEES[1] Regulations. The proposed future trajectory for MEES is an EPC ‘B’ by 2030 for non-domestic properties and an EPC ‘C’ by 2025 for domestic properties in the Government’s Energy White Paper[2]. Measures to improve the EPC rating to align with this trajectory and an understanding of the associated costs and implementation challenges are an early check point in the decision-making process.

2) Operational performance

EPC ratings only give a theoretical energy performance of buildings, and it is widely known that the actual energy use of buildings varies significantly depending on how well they are maintained and operated and the behaviour of occupants. Therefore, establishing the Energy Use Intensity (EUI) using current metered data or available benchmarks for the asset are another check to understand the level of investment likely to be needed to improve energy efficiency, lower bills and enhance asset value.

3) Net zero carbon

As part of wider net zero ambitions, organisations are aiming to align the asset EUI with operational energy performance targets set by UKGBC[3], RIBA[4], LETI[5] or CRREM[6] which are more broadly co-related to limiting temperatures to a 1.5° world. Alongside energy consumption targets, the other consideration for net zero is the move away from fossil fuel systems to all–electric to align with the decarbonisation of the grid, projected to become nearly zero carbon early in the 2030s. The EUI benchmarking and Fuel Source for the asset thus become two early due diligence signposts on the journey to Net Zero.

4) Electric vehicle infrastructure

With the Climate Change Committee’s recommendation that 100% of new vehicle sales should be electrically propelled by 2030 there has been a spotlight on charging infrastructure in real estate to reduce ‘range anxiety’. Feasibility considerations and costs for electrical capacity and ducting to provide charging points for residents, staff and visitors are increasingly becoming an early checkpoint in response to market demands, more vital for some assets such as logistics than others.

5) Occupational wellbeing

Focused more on the ‘S’ of ESG with the pandemic accelerating the demand for healthy buildings, assets with the potential for certification under WELL[7] and Fitwel[8] or aligned with their principles are growing in popularity and commanding rental premiums. The site’s walkability, access to public transportation, facilities for cyclists, levels of daylight, access to shared spaces and enhanced Indoor Air Quality provision are some of the occupational wellbeing indicators to incorporate within due diligence findings.

6) Ozone-Depleting Substances (ODS) and Fluorinated-Gas (F-Gas)

From 1 January 2021, UK regulations effectively transferred the requirements of the current EU regulations directly into UK legislation, restricting the use of ODS and maintaining the phase-down schedule for F-Gases. Due diligence checks on the presence of ODS on site such as the refrigerant gas R22, one of the last remaining in common use or the F-Gas HFC 404A, commonly used in industrial and commercial refrigeration systems, can provide an early indication of refurbishment and maintenance works needed post-acquisition to align with phase down schedules.

7) Biodiversity

Biodiversity net gain, or leaving the environment in a measurably better state, is set to be a key ESG focus with the launch of the newly formed Taskforce on Nature-related Financial Disclosures[9] (TNFD) and stronger government commitments. The existence of green walls, roofs, beehives, bird and bat boxes providing breeding, nesting and feeding opportunities with a diverse mix of native species can facilitate the achievement of biodiversity targets for businesses. The due diligence process can serve as a critical early marker to highlight existing biodiversity value needing protection and enhancement opportunities.

8) Certification systems

Green building certification schemes such as BREEAM[10] or LEED[11] provide a multi-dimensional method that assess a building in terms of environmental, social and governance issues. They lead to an increased awareness towards the building and its impact on the environment and people enhancing asset value and commanding rental premiums. For an existing asset with no certifications in place, a desktop due diligence against a scheme like BREEAM In-Use[12] can provide a holistic understanding of ESG readiness under the themes of management, health & wellbeing, energy, transport, water, resources, land use and pollution.

9) Climate resilience

Overheating and flooding are two of the main physical risks faced by assets across the UK. Any existing evidence of thermal discomfort based on occupant behaviour and supported by site observations around the building orientation, glazing, use of shading devices / blinds and potential for enhanced levels of ventilation can serve as an early warning indicator. Long term flood risks from rivers, seas, surface and ground water investigated based on data from the Environment Agency supported by any known local risks from canals or sewers can provide an indication of risks needing mitigation or adaptation measures.

10) Waste

With many businesses aiming for zero waste, there is a growing focus on reduce, reuse and recycle targets, eliminating avoidable plastic waste and significantly preventing marine plastic pollution that originally came from land. The due diligence process not only provides an opportunity to highlight evidence of any risks associated with hazardous and regulated waste streams but for non-hazardous waste can lead to early identification of opportunities within the collection, segregation and collection process to maximise waste prevention.

As a final thought, and whilst it is tempting to pursue a ten-point checklist, does the industry need a framework for ESG due diligence that provides sufficient structure and consistency to make informed decisions yet leaves flexibility to inevitably take into account the constantly changing ESG landscape?

If you would like to discuss the points raised or get advice on your ESG due diligence strategy, please get in contact with Snigdha Jain.

10 March 2022

[1] Minimum Energy Efficiency Standard

[2] https://www.gov.uk/government/publications/energy-white-paper-powering-our-net-zero-future

[3] https://www.ukgbc.org/wp-content/uploads/2020/01/UKGBC-Net-Zero-Carbon-Energy-Performance-Targets-for-Offices.pdf

[4] https://www.architecture.com/about/policy/climate-action/2030-climate-challenge

[5] https://www.leti.london/cedg

[6] https://www.crrem.org/pathways/

[7] https://www.wellcertified.com/

[8] https://www.fitwel.org/

[9] https://tnfd.global/

[10] https://www.breeam.com/

[11] https://www.usgbc.org/leed

[12] https://www.breeam.com/discover/technical-standards/breeam-in-use/

You may also be interested in

News

4 February 2022

Brueacre Village on former Inverkip Power Station site granted permission in principle

Acting on behalf of ScottishPower, Turley has secured Planning Permission in Principle (PPP) from Inverclyde Council for the creation of 650 ...